Financial Planning and Investment for Aquaponic Ventures

The aquaponic industry is booming, attracting both sustainability advocates and savvy investors. But turning an aquaponic dream into a thriving business requires more than just a great idea—it demands solid financial planning. In this guide, we’ll break down aquaponic business finance, covering everything from investment strategies to funding sources, ensuring your venture not only survives but thrives.

1. Understanding the Costs of an Aquaponic Business

Starting an aquaponic farm isn’t just about setting up tanks and planting seeds; it requires a clear grasp of financial commitments. Let’s break it down:

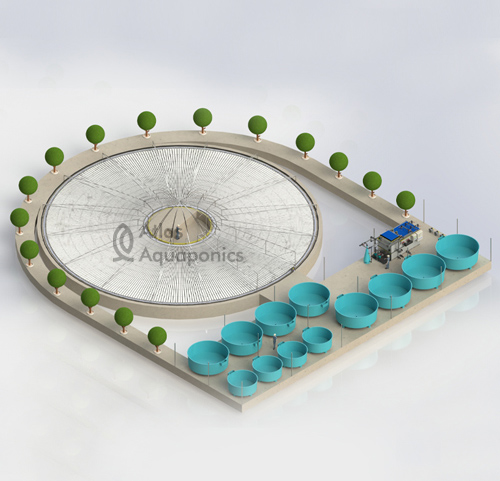

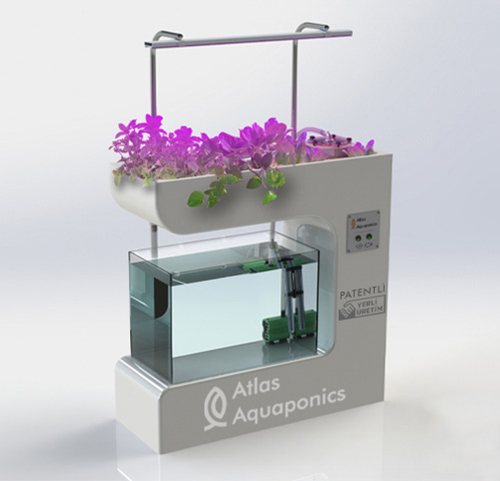

- Initial Setup Costs: Expect expenses for land, greenhouse structures, fish tanks, plumbing, water filtration systems, and aeration equipment. High-tech additions like automated monitoring systems can enhance efficiency but increase initial costs.

- Operational Costs: These include recurring expenses like electricity, fish feed, plant nutrients, labor, and packaging. Don’t forget water quality testing and system maintenance, which are crucial for long-term sustainability.

- Unexpected Costs: Equipment breakdowns, regulatory compliance updates, and pest or disease outbreaks can throw unexpected financial curveballs. A contingency fund is essential.

A well-structured financial plan should outline projected costs, estimated revenue, and a break-even timeline to keep your business on track.

2. Investment Planning for an Aquaponic Business

A strategic investment approach can make the difference between a thriving business and a failed venture. Here’s how to set yourself up for success:

- Define Your Business Model: Are you focusing on high-end organic produce for gourmet restaurants, large-scale commercial fish production, or educational programs? Your model dictates your financial needs.

- Diversify Revenue Streams: Successful aquaponic businesses sell not only fish and vegetables but also seedlings, compost, live fish for aquariums, and even host agritourism experiences.

- Break-even Analysis: This critical step determines when your business will start turning a profit. Factor in production costs, market demand, and pricing strategies.

- Risk Mitigation: Identify vulnerabilities—climate-related risks, supply chain disruptions, or sudden market shifts—and have a financial backup plan in place.

3. Funding Sources for Aquaponic Ventures

Funding is often the biggest challenge for new entrepreneurs, but there are multiple ways to secure the capital needed to launch and grow an aquaponic business:

- Personal Savings and Bootstrapping: Many entrepreneurs self-fund their initial operations to maintain full ownership and control.

- Bank Loans and Credit Lines: Traditional financing options, including small business loans, can provide capital, but securing these requires a strong business plan and credit history.

- Government Grants and Agricultural Subsidies: Many regions offer grants to promote sustainable farming and food security initiatives.

- Angel Investors and Venture Capital: Sustainability-focused investors are increasingly looking at aquaponics as a future-forward business.

- Crowdfunding and Community Support: Platforms like Kickstarter allow you to raise capital while generating interest in your business before launch.

- Joint Ventures and Partnerships: Collaborating with local restaurants, grocery chains, or research institutions can provide both funding and guaranteed customers.

4. Advanced Financial Management Strategies

Once funding is secured, keeping a firm grip on financial management is crucial:

- Develop a Financial Forecast: Map out projected revenue, costs, and profit margins for the next 3-5 years.

- Adopt Smart Accounting Practices: Use software like QuickBooks or Xero to track cash flow, profits, and expenses with precision.

- Monitor Key Performance Indicators (KPIs): Metrics like cost per unit of production, revenue per square foot, and return on investment (ROI) can guide decision-making.

- Optimize Operational Efficiency: Cutting energy consumption with renewable solutions and improving feed conversion ratios can reduce long-term costs.

- Plan for Scaling Up: As demand grows, expanding operations strategically—whether by increasing production or diversifying offerings—ensures long-term success.

Final Thoughts

Building a profitable aquaponic business isn’t just about passion; it requires meticulous aquaponic business finance planning and smart investment strategies. Understanding costs, securing the right funding, and managing finances wisely will position your venture for long-term success. Whether you’re just starting or looking to expand, financial discipline will be your best asset in this ever-evolving industry.